- The Americas Report

- Posts

- Eyes Are on Rate Cuts & SpaceX Rocket Hits Space

Eyes Are on Rate Cuts & SpaceX Rocket Hits Space

Good Morning,

I want to start off by saying due to unforeseen circumstances I wasn’t able to produce any update for two months. Now I’m back and ready to deliver more news and insights every Sunday.

U.S equities finished finish a tad higher, as investors look at the possibility that the Federal Reserve might cut rates.

The TSX finished higher as the oil sector helped prop up the index. Disinflationary data help lift gov’t bonds.

The yield on the Brazil’s 10-yr gov’t bond dropped under 11% following American counterparts.

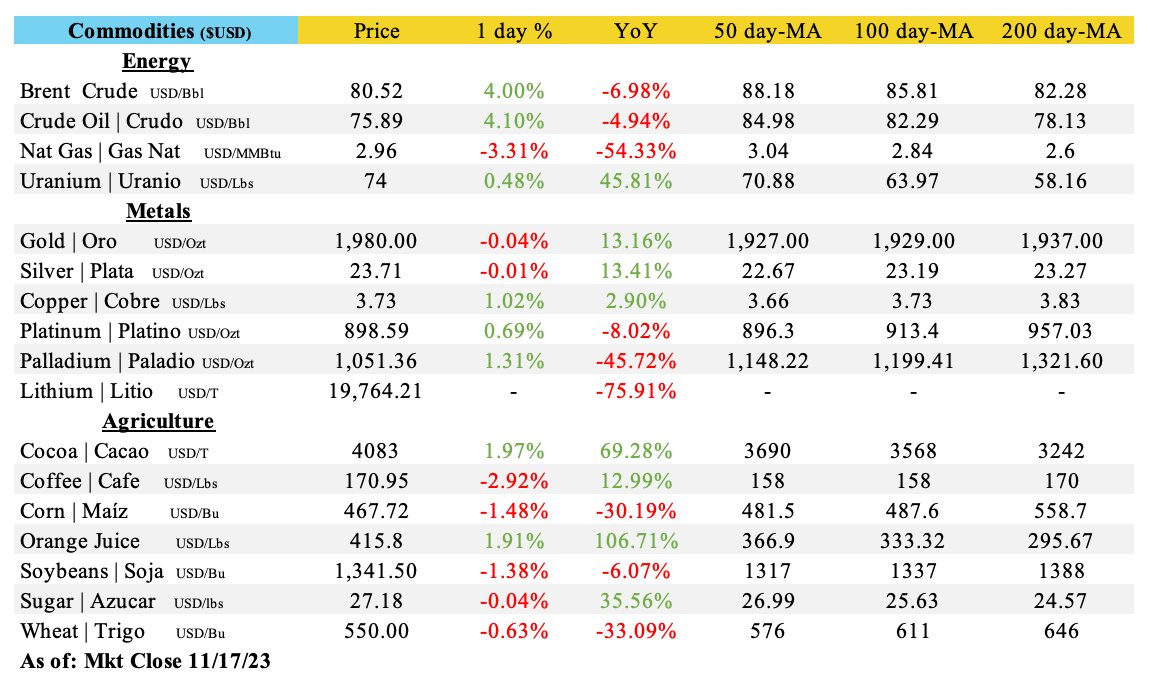

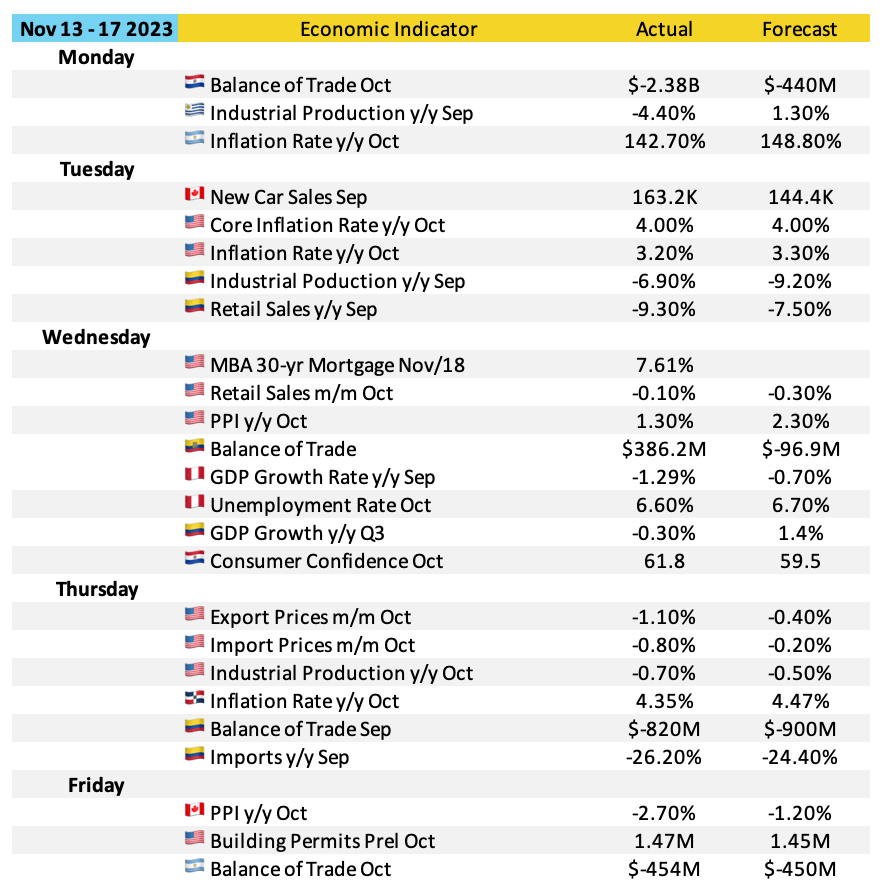

Markets:

Top News Stories

Canada

Millennials had the majority drop of home ownership in over a decade (BNN)

Slate Office REIT took a dive after suspending its monthly cash payouts and sell assets (BNN)

The federal gov’t commits C$ 1.2B to build 2,644 new rental units (BNN)

Heroux-Devtek reports a C$ 4.6M Q2 profit (BNN)

Amazon’s wind farm project to be located in Alberta (BNN)

Aeroplan members can now earn points at Parkland Corp gas stations (BNN)

Loblaw continues its expansion with strong earnings (BNN)

Canaccord sees Capital Markets drop as Wealth Management rises (BNN)

Manulife cuts 250 jobs (BNN)

US – Canada rail line gets more attention (BNN)

CAE reports strong earnings due to pilot training (BNN)

SQDC report Q2 net income up 11.7% to C$ 24.9M (MG)

Quebecor plans to launch Fizz brand Western Canada shortly (MG)

Average home price hits C$ 656,625 (MG)

Manufacturing & Sales up in Sept. (MG)

Average Canadian rent hits new high after six straight months (MG)

B.C. Premier Eby and Trudeau announce C$ 1B batter cell production plant in Maple Ridge, B.C. (VS)

U.S.

SpaceX rocket reaches space then intentionally destroyed (CNBC)

Sam Altman is out of OpenAI (CNBC)

Media companies stop advertising on X (CNBC)

JAT Capital send letter to new Bed Bath & Beyond board over CEO removal (CNBC)

Cadillac releases its new entry level EV (CNBC)

Sierra Space lays off hundreds of workers (CNBC)

GAP beats earnings estimates (CNBC)

UAW closes out deal with automakers (CNBC)

Citigroup starts layoffs as part of CEO’s plan (CNBC)

Fisker reports “material weaknesses in financial reporting (CNBC)

Tech stocks finish with a three week rally (CNBC)

Buyers in U.S. Treasuries have dropped over a decade (WSJ)

FDIC has a work culture problem (WSJ)

Argentina

Debt of $22M pushes banana & pineapple producers in Bolivia & Paraguay to stop exports (BAT)

With a worsening drought, Argentina sees Soy supplies dropping (BAT)

Flybondi plans expansion to Brazil via SPAC deal (BAT)

Banks pile up on cash as peso withdrawals loom after run-off vote (BAT)

Trade deficit dropped to $454M in October (EC)

Brazil

Coffee exports rise to rival those of Vietnam & Indonesia (RIO)

City rail lines grew 17% in a decade (RIO)

Brazil stock market hits record high on Nov 16 2023 (RIO)

Agricultural exports in ’23 made Brazil $140B between Jan – Oct, half of Brazil export income (RIO)

China is the main buyer of Brazilian beef, accounts for 49% of exports (RIO)

Lula asks Petrobras to change investment plan for jobs focus (RT)

Costs continue to rise for Poultry & Pork industry (RIO)

State owned enterprises face a $5.6B deficit in ’23 (RIO)

Colombian economy could grow only 0.9% this year, per Banco de la República (ELT)

Cities most affected by drop in homes sales (ELT)

Colombia

Salaries rise 11.18% this year (PORT)

Gov’t to cut $4B pesos in 2023 budget after ruling on royalties (PORT)

Delays plague El Dorado last Friday as staff shortages hit Aerocivil (PORT)

Ecopetrol rose this week as the constitutional court ruled against a raise in royalties against oil producers (PORT)

Kaszek ventures invested $15M on Gopass, the largest transport ecosystem in Colombia (PORT)

Avianca takes back operations in Venezuela, announces route Caracas – San Jose, Costa Rica (PORT)

Grupo Sura reported earnings of $26.5B pesos in Q3 2023 (PORT)

Dominican Republic

Ecuador

Exporters calculate a 10% increase in costs due to cuts in electric subsidies (ELU)

Ecuador legislature starts new session (RT)

Guayaquil ports looks to close this year with 500K containers moved (ELU)

Petroecuador bloques 16 & 67 have a production of 10K barrels a day (ELU)

Ecuador & Dominican Republic agree on formal trade deals (ELU)

Mexico

Biden and AMLO discuss topics like drugs & migration on last day of APEC (RT)

IMF approves credit line of $35B for Mexico (RT)

Dos Bocas oil refinery to be profitable in 20 years (MB)

Mining companies report strong Q3 earnings (MB)

Aeroméxico team up with IBM for AI weather forecasting (MB)

Credito Real files for bankruptcy protection (MB)

Citibank infuses $466M into Mercado Pago’s Mexico & Brazil operations (MB)

New Intermodal service revealed between Mexico & U.S. (MB)

Panama

Peru

Minister of the Interior will resign (ELC)

President Dina Boluarte meets with business heads at APEC (ELC)

Prices of international flights from Peru drop 16% in ’23 (GES)

Colombian businesses invest $500M in Peru during 2023 (GES)

HAPI raised $1.6M to let Peruvians access the U.S. capital markets (GES)

Chinchero Airport advances work by 8% to reach 2025 completion date (GES)

Protecta Security issues bonds for $25M (GES)

Scharff invests $3M soles for automation purposes (GES)

Unilabs invests $2M to open 10 locations in 2024 (GES)

Thanks for making it this far in the newsletter. If you have any feedback, please reach out anytime. Feel free to refer your friends and colleagues to subscribe. The more subscribers, the bigger our community will be. Stay tuned for more content on the way

DISCLAIMER: The above is not financial advice or solicitation to buy/trade any financial product/security. This newsletter is for educational purposes only. Any action/decision made by any reader is made of their own free will. Financial markets are full of risk, so be careful.